The Great Divergence

As America's economy weakens and its policies alienate allies, a "great divergence" is creating new regional economic powers and fundamentally reshaping the postwar global order

The US economy is weakening, but this is no ordinary down-cycle. Powerful centrifugal forces in the system are at work—splitting the West, reshaping the world order, and transforming the global economy.

The US entered this down-turn cycle as the world's leading economy with the most powerful currency. It stood as a technological juggernaut, the globe's uncontested military superpower, and a diplomatic heavyweight enjoying an unmatched network of allies. It was both an outstanding defender of democracy and the underwriter of the rule-based world order. By the end of this cycle, however, America is likely to emerge as a radically weakened country into a scarcely recognizable world.

The global economy is undergoing a historic restructuring, where multiple regional economic centers are beginning to emerge and develop away from the United States. Call it a "great divergence". A phenomenon that will change the center of gravity of the world economy and its geopolitical configuration in years to come.

The Gathering Storm

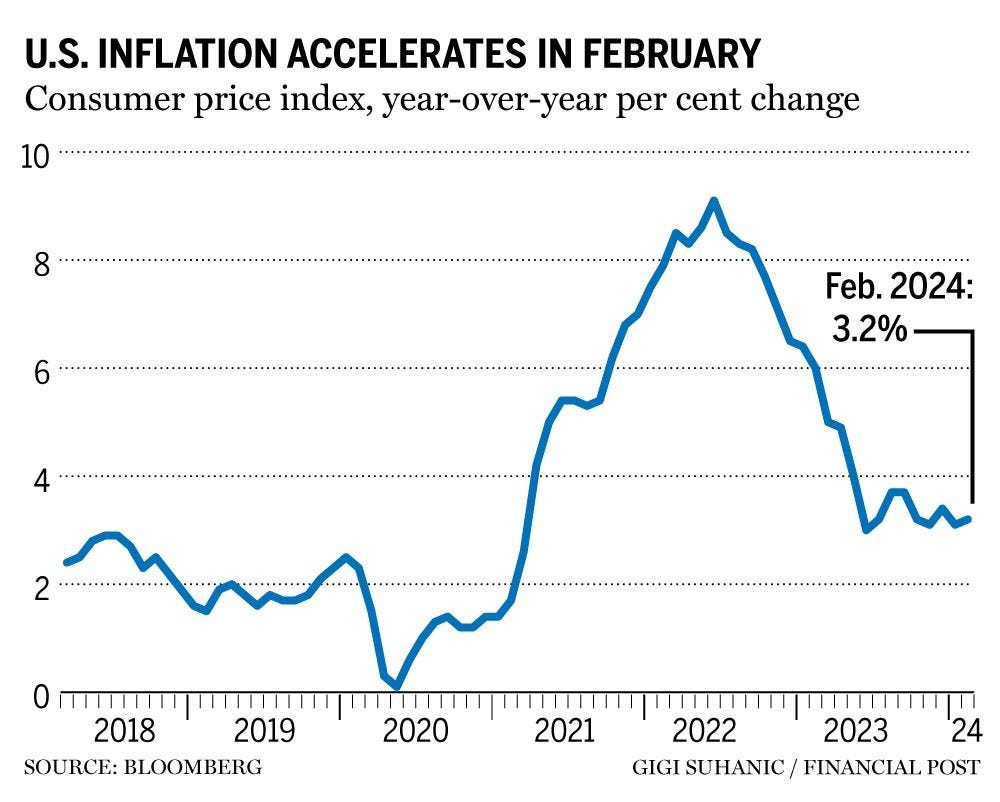

Start with America's short term economic challenges that are chipping away at its perceived economic hegemony. The prevailing economic sentiment in the United States less than 100 days into the Trump presidency is one of heightened uncertainty and increasing worry about the potential for stagflation. Stagflation happens when economic growth is sluggish and inflation is high.

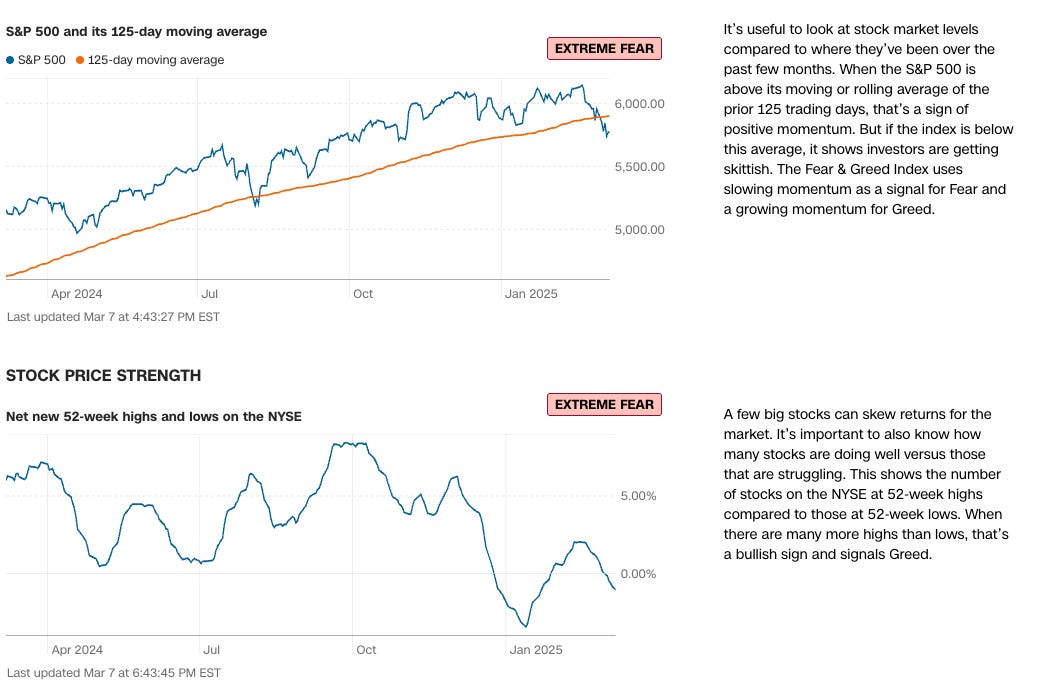

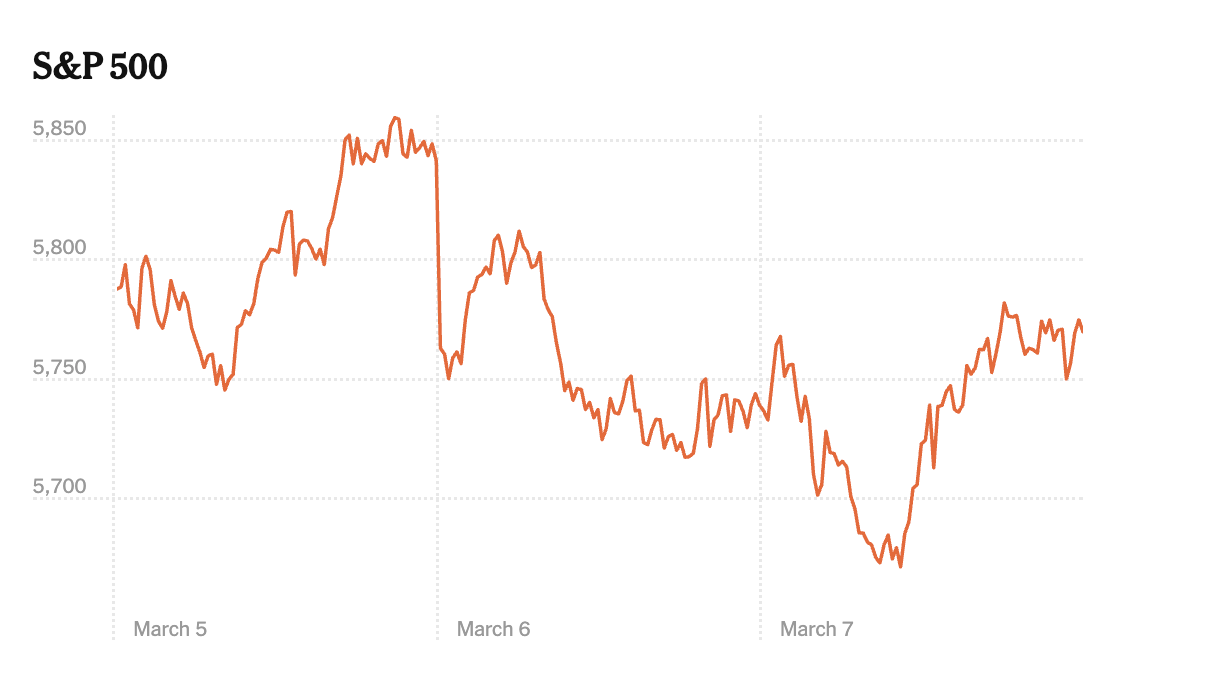

Trump's implementation of tariffs on imports from Canada, Mexico and China on March 4th is a classic stagflationary shock. These trade measures—which Warren Buffet characterizes as akin to a declaration of war—push up prices for consumers. They also act as a headwind to economic growth by disrupting trade and potentially leading to retaliatory measures. Indeed, all countries targeted by Trump's tariffs have threatened to retaliate. The stock market reacted violently this week to America's assault on global trade, with major indices edging deep into red territory during the week, which the announced 30-day tariff reprieve on the following day did little to reverse.

The Trump administration's wavering policy on tariffs is weighing heavily on the economy. By imposing, delaying, and threatening tariffs on numerous countries, it keeps inflation persistently above the Fed's 2% annual target. Whether this approach is part of a dealmaking masterplan or simply reflects the whims of an erratic and vindictive president remains unclear.

The uncertainty is setting in. The University of Michigan's consumer survey published in February revealed that Americans' inflation expectations for the year ahead have jumped to levels not seen since November 2023, suggesting that inflation fears are becoming entrenched in the collective economic psyche. The consensus forming among consumers, companies, investors and the Federal Reserve is that inflation will be higher over the next five years.

Typically, the Fed would be reluctant to cut interest rates if inflation is high for fear of overstimulating an already booming economy. But this would only make sense if inflation was being caused by a hot economy. Alas, that is not the case today. Instead, we are witnessing inflation born not from abundance but from rising costs that strangle rather than stimulate economic growth. This scenario presents the Fed with a rather complicated dilemma. Raising interest rates to combat inflation could further weaken the economy, while lowering rates to stimulate growth could exacerbate inflation.

The second scenario seems the most likely. Indeed, all economic indicators seem to suggest that economic growth in America is flailing.

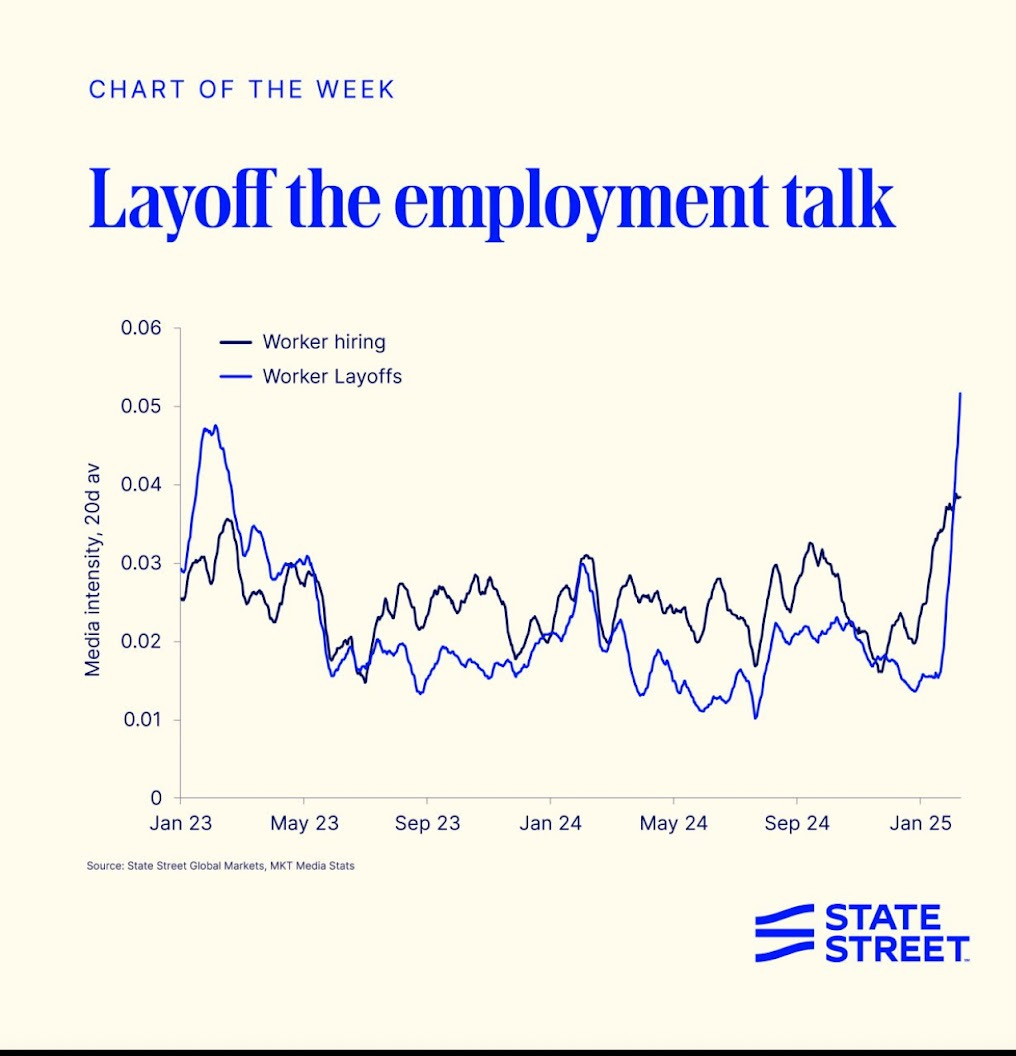

Consumer spending has fallen 0.5% in real terms from a month earlier, the biggest decline in nearly four years. In February, consumer confidence sank to an 8-month low. Meanwhile, private-sector hiring has slowed considerably. From January's 4.0%, the unemployment rate has ticked up to 4.1% in February. Despite a decent job gain of 151,000, the labor market is expected to soften further due to tariffs, federal spending cuts, and government layoffs. Initial claims for unemployment insurance in the last week of February rose to 242,000, matching their highest since October. Weekly jobless claims look more worrisome following Elon Musk’s aggressive cost-cutting push via the so-called Department of Government Efficiency (DOGE). According to Apollo Global Management, job cuts related to DOGE could rise to 300,000. When including contractors, this figure might approach one million total layoffs.

Investors are catching the gloomy mood. Stocks rose strongly after Trump’s election victory in anticipation of his deregulatory and tax-cutting agenda. However, the main effect of his presidency has been a $3 trillion reduction in the value of U.S. stocks since his January 20 inauguration.

Source: FactSet By The New York Times

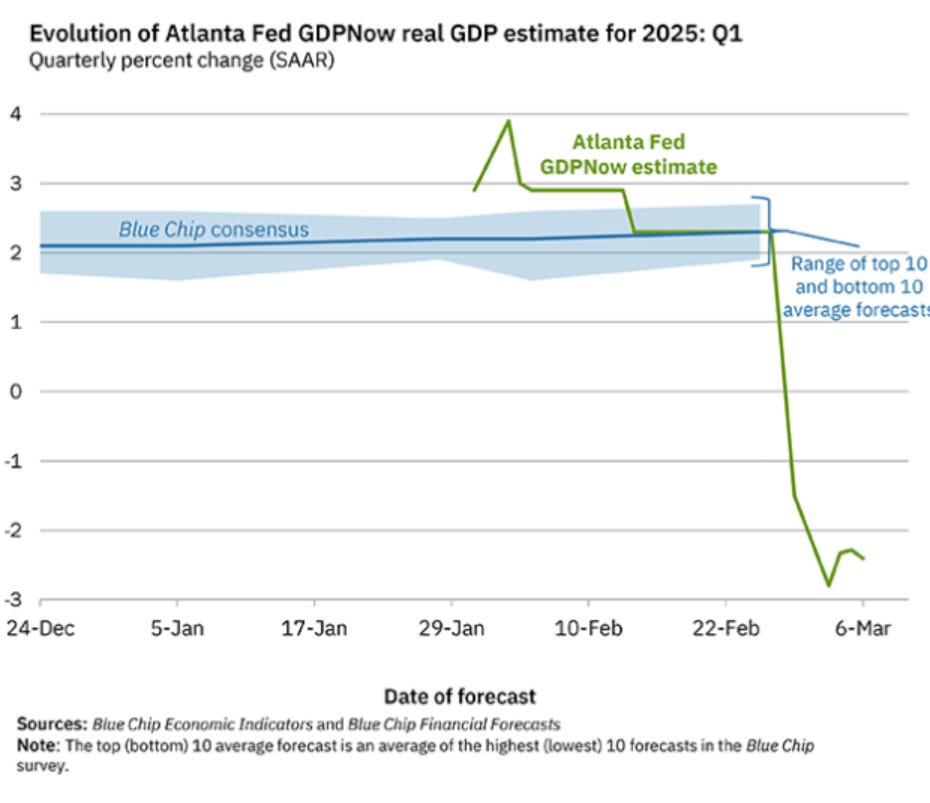

And yet, in this profusion of disappointing economic data, the most damning indicator is perhaps the one pointing to a likely economic recession. According to a high-frequency tracker of GDP growth (GDPNow) published by the Federal Reserve’s branch in Atlanta, the economy is projected to suffer a 2.8% contraction in the first quarter of 2025, an abrupt reversal from just a few weeks ago and a significant downward revision from its earlier estimate of -1.5% on February 28 and an initial positive forecast in January.

Most commentators dismiss the risk of an impending economic recession, but the bond market is actually predicting one within a year.

In classic fashion, of course, the message is being conveyed to the market obliquely by a rather obscure euphemism known as the "inversion of the Treasury yield curve". You see, since February, short-term Treasury yields are higher than long-term yields. Normally, long-term yields are higher because investors require greater compensation for the uncertainty associated with longer investment periods. This inversion of the curve means that bond investors are demanding long term bonds to lock in higher interest rates today, because they anticipate that short term rates will fall in response to the Fed's cutting of rates to spur economic growth. Higher demand means higher bond prices. When bond prices rise, their yields fall, and vice versa. Therefore, the newly inverted yield curve indicates that investors expect a recession in the short term that could spur the Fed into rate-cutting action.

Red Ink Rising: The Looming Debt Reckoning

Unfortunately, the bad news for the American economy don't end there. There is tremendous financial risk lurking under the surface that could erupt at any moment. The most urgent one is America's unsustainable debt situation. Ray Dalio, a prominent hedge fund manager, has warned of a potential "debt-crisis heart attack" within three years if the U.S. doesn't rein in deficit spending. His concern is widely shared. The fact that a remarkable 77% of financial professionals surveyed by the CFA Institute before the 2024 election said U.S. government finances are unsustainable highlights the pervasive concern about this systemic risk.

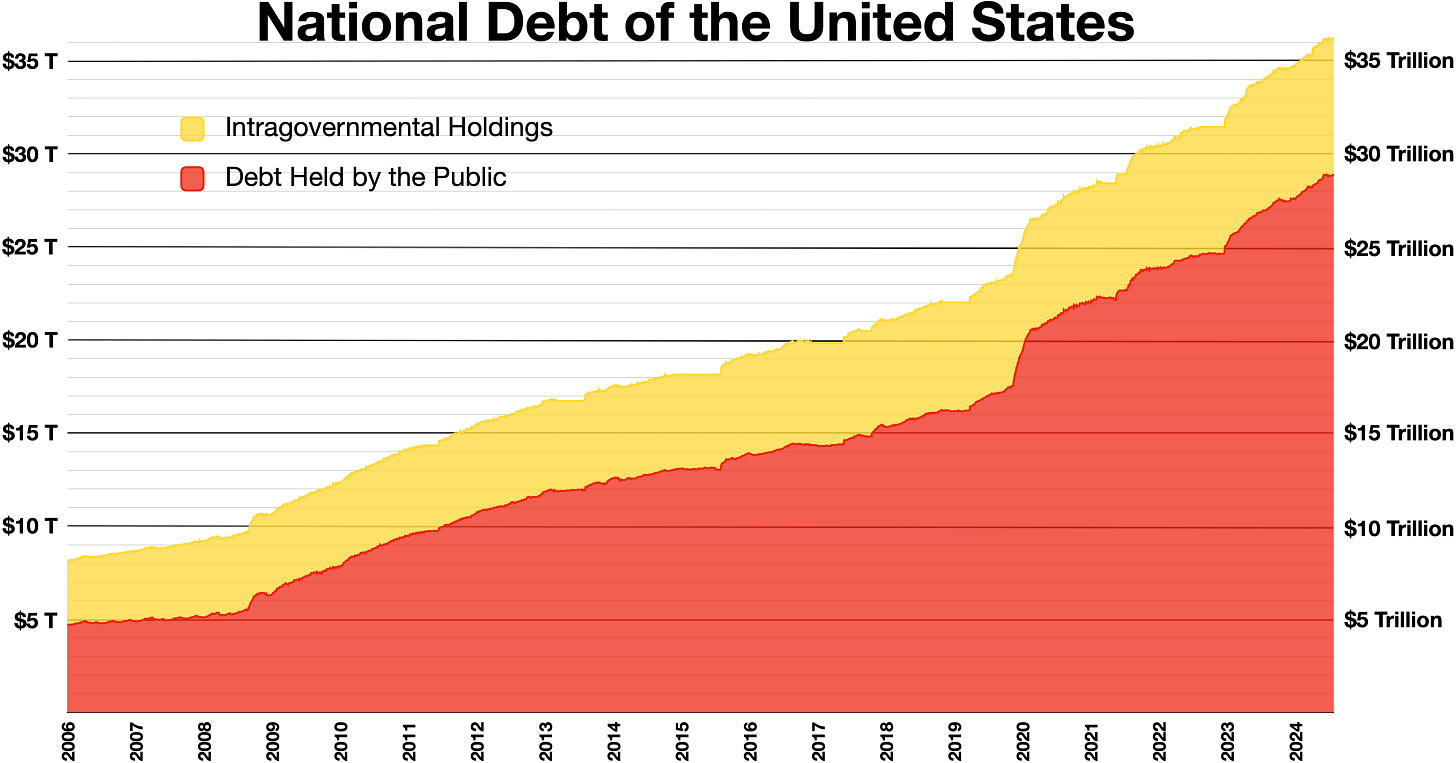

Their alarm is justified. The federal debt has grown to $28.3 trillion as of the end of 2024. A 7.6% year-over-year increase. An alarming 68.1% jump since the pre-COVID average.

It's a remarkable level in a non-recession, non-war, and non-emergency year. Moreover, the debt-to-GDP ratio is at a historic high. The federal deficit stands at $1.8 trillion, the second-highest recorded, or 6.3% of GDP, a level greater than during the Great Depression and the dot-com bubble burst.

The proposed budget resolution approved by the House last week is not encouraging or a sign that the seriousness of America's fiscal predicament has fully sunk in among the country's political class. The proposed extension of the Trump tax cuts of 2017 are not fiscally stimulative. The additional tax cuts benefiting the country's highest earners, funded by nearly $1.5 trillion in Medicaid and food stamp cuts, would deprive lower-income Americans of essential services. These policies would also saddle the country with an additional $4 trillion deficit over the next decade.

The bill is unlikely to clear the Senate, which in turn raises questions around a possible government shutdown.

But the seasoned eyes of investors and financial managers are actually focused on the possible reaction of the bond market. If the government has to borrow money to service its debt, it could incur the fury of bond vigilantes.

Interest payments on the nation's debt will reach $925 billion in 2025 and will exceed $1 trillion the following year. The consequences could be severe. At a certain point, bond buyers might balk when called upon to buy more Treasury bonds, sending U.S. bond yields soaring.

Rising government bond yields are a sign that investors are losing faith in the government’s ability to manage the economy. Bond vigilantes are a sort of market watchdogs that challenge the notion of “free government spending”. They act by selling government bonds when they believe government policies have become fiscally reckless or unsustainable. Their collective selling pushes yields higher, effectively raising borrowing costs across the economy. This would not only push the U.S. economy into a recession, it would likely suck it into, to use Ray Dalio's metaphor, a debt death spiral.

The Great Unfriending

Unlike previous economic downturns, today's somber financial landscape is due to a fundamental shift in driving forces. Geopolitical risk, not traditional economic indicators, now serves as the guiding narrative for global financial markets. For eight decades following World War II, globalization and open markets shaped the economic world order. Yet, in a mere two-month span, we've witnessed a transformation into a world dominated by geopolitical risk, conflict and great power competition—rapidly reconfiguring established global structures and alliances with far-reaching consequences.

Trump's economic policies, based on slapping punitive tariffs against America's closest allies and partners are creating strong incentives for Europe, Canada, Mexico and Australia, among others, to decouple from the American economy. In a matter of just a few chaotic weeks, President Donald Trump has begun to fashion a new world economic order. One in which America will be less prosperous, less influential and less safe.

History holds important lessons in this respect. A recent article by The Economist compares Trump's tariff policy to the Smoot-Hawley tariffs of 1930, which raised average import levies from 40% to 60% by 1932. These tariffs are often blamed for the Great Depression, but the more significant damage came from how they divided democratic nations into rival trade blocs that mostly traded within their own spheres of influence rather than with each other. Britain created "imperial preferences" establishing tariff walls around the British Empire, and similar policies were adopted by the Dutch and French empires. This division had serious consequences. It shut out countries like Japan from important markets, strengthening hardliners and weakening moderates in Japanese politics.

As Trump raises trade barriers, the democratic world has been once again forced to forge new economic alliances that sideline the U.S., accelerating a shift toward regionalized and diversified trade networks that reduce dependence on American markets. The European Union, for example, entered into a free trade agreement with Mercosur that would eliminate tariffs on over 90% of bilateral trade, it just concluded an updated trade agreement with Mexico for food and agricultural products, an Economic Partnership Agreement with Japan seeking to reduce 100% of all tariffs in the next ten years, and a comprehensive free trade agreement with Switzerland. In parallel, it is pursuing free trade negotiations with India, Indonesia and Philippines with renewed urgency. On February 12, Canadian Prime Minister Justin Trudeau met with EU leaders in Brussels to discuss strengthening economic ties as both regions are threatened by U.S. tariffs.

Outside of Europe, the BRICS is expanding its membership lineup, with Indonesia recently joining the club and eight more countries (including Bolivia, Thailand and Kazakhstan) applying for a spot. China has renewed its free trade agreement with ASEAN, integrating Vietnam, Indonesia, Cambodia and the Philippines to its trade network. China has also overtaken the U.S. in exports to ASEAN nations, solidifying its dominance in the region. Britain has joined the trans-pacific trade bloc, aligning itself with Japan, Canada, Australia and Latin America. Brazil and Mexico exploring new trade partnerships to reduce their reliance on America, while Gulf nations in the Middle East are shifting focus to Asia, with over 70% of their oil exports now going to India and China. Approximately 60% of Asia’s trade now happens within the region, reducing reliance on Western markets. Global trade is therefore adapting rather than collapsing—nations are finding new routes around U.S. barriers rather than through them.

The trading blocs that developed as a result of the Smoot-Hawley tariffs also fueled anti-American feelings in countries like Cuba, whose economy collapsed when it couldn't sell sugar to the US, leading to an anti-American revolution in 1933. Back to the present, anti-American sentiment has surged to record highs in Canada, historically America's closest and most dependable ally and trading partner. Canadians are actively avoiding American products and seeking out Canadian-made alternatives. 62% of Canadians plan to avoid traveling to the U.S. for at least the next year due to political tensions, with only 9% of Canadians intending to visit the United States in 2025, a sharp decline in U.S.-bound travel amid a surge of Canadian patriotism and vociferous anti-Americanism. Countries affected by the Smoot-Hawley tariffs that couldn't directly retaliate with tariffs used other methods like import quotas and consumer boycotts. Today's boycotts of Tesla cars across Europe and Canada has echoes of the Italian boycotts of American cars in the 1930s.

Canadians booing the American National Anthem

Trump's economic and foreign policies have also forced a fundamental reshaping of global geopolitics. America's sudden alignment with Russia, its betrayal of Ukraine immortalized in the shameful televised dress-down of Zelensky in the Oval Office, its overt hostility towards Europe, the economic warfare it is waging against its closest allies and partners, its expansionist and bellicose rhetoric threatening the sovereignty and territorial integrity of its own allies, its embrace of a zero-sum transactional diplomacy for the exclusive benefit of the U.S., its abandonment of alliances, security arrangements and trade agreements around the world and its relinquishment of global leadership symbolized by its scrapping of USAID and its withdrawal from the WHO and the Paris Climate Agreement have all but confirmed the end of the 1945 world order.

The most immediate consequence? Europe's growing realization that NATO may no longer be reliable. This alliance—the world's most powerful military coalition—had brought peace and stability to the international system for over eight decades. But if Russia were to attack a NATO member in Europe today, America would likely not honor its collective security obligation under the NATO charter. This means that after an eighty-year reprieve, Europe must once again shoulder the burden of its own defense without the American security umbrella.

The timing couldn't be worse. While Europe's economy continues to sputter from the triple shocks of COVID, the Sino-American trade war and Russia's invasion of Ukraine, its countries face multiple challenges simultaneously: mounting public debt, crippling bureaucratic red tape, excessive regulation, a rapidly aging population and a rising tide of Trump-inspired populist movements. Yet, it is doing all it can to rise to the moment in this critical juncture of history where Ukraine risks being abandoned, and Russia strengthened.

The historic dimension of this moment was savagely captured in the fiery speech of French senator Claude Malhuret who declared: "Washington has become the court of Nero: an incendiary emperor, submissive courtiers, and a buffoon on ketamine tasked with purging the civil service." He went on to say: "Trump’s message is that being his ally serves no purpose, because he will not defend you, he will impose more tariffs on you than on his enemies, and he will threaten to seize your territories, while supporting the dictators who invade you." And he concluded his scathing assessment by noting that "Never in history has a president of the United States surrendered to the enemy. Never has one supported an aggressor against an ally . . . We were at war with a dictator; now we are fighting against a dictator supported by a traitor."

Defending Europe and the free world will require a massive investment to replenish the European Defense Fund beyond the Maastricht debt criteria, harmonize weapons and munitions systems, accelerate European Union membership for Ukraine, which now has the leading army in Europe, rethink the role and conditions of nuclear deterrence based on French and British capabilities, and relaunch missile-shield and satellite programs. The newly elected German chancellor, Friedrich Merz, is on board with the project. In the face of America's indifferent hostility towards Europe, he is calling for greater European autonomy away from America, creating a European nuclear umbrella to replace U.S. nuclear assurances, diversifying Europe’s arms procurement away from reliance on the United States and potentially replacing NATO with an independent European defense capability if U.S. support continues to wane. To achieve this, he believes Germany should take a leadership role.

Germany has therefore proposed a major expansion of its defense and infrastructure expenditures, marking a significant shift in its fiscal policy. The parties hoping to form Germany's next government agreed to create an off-budget 500 billion euro ($531.33 billion) infrastructure and military fund and to overhaul borrowing rules. In addition, the European Union is proposing a significant increase in defense spending, which could mobilize close to €1 trillion over the coming years under the ReArm Europe Plan to invest in air and missile defense systems, drones, artillery, cyber capabilities, and artificial intelligence.

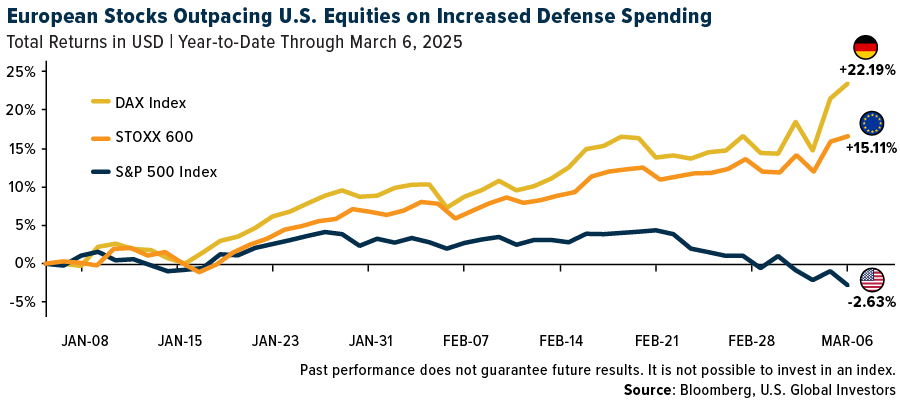

This proposal, which would see Europe match and potentially surpass America's defense spending, cheered the euro and boosted both German and European defense and security stocks this week reflecting optimism for stronger growth which was further supported by the European Central Bank's decision to cut its key interest rate to 2.5% from 2.75% to stimulate economic growth.

The New World Order: Navigating America's Diminished Horizon

The United States is drifting toward its own "Brexit" moment - a self-inflicted wound with potentially irreversible consequences. Through misguided policy shifts, America risks diminishing its global standing and economic prosperity. The alarming transition from alliance-based leadership and established international norms to transactional, deal-driven politics prioritizes fleeting gains over long-term stability. This approach will likely embolden America's rivals and reinforce a strategic Sino-Russian alignment against Western interests. Perhaps most concerning is the erosion of trust among traditional allies. As America's reliability comes into question, partners will seek alternative arrangements that exclude U.S. influence. Meanwhile, the normalization of territorial negotiations and economic coercion as diplomatic tools threatens to increase global instability and conflict. The cumulative effect of these changes threatens to leave America economically weaker, diplomatically isolated, and fundamentally less secure in an increasingly competitive world order.

The Great Divergence represents a pivotal moment in global economic history—one that will reshape the international order for decades to come. America's economic challenges, unsustainable debt, and diplomatic isolation are not merely cyclical problems but symptoms of a deeper structural transformation. As regional economic blocs solidify and new geopolitical alliances form, the unipolar moment that defined the post-Cold War era appears to be ending.

The consequences extend far beyond America's borders. Europe's renewed focus on strategic autonomy, Asia's growing intraregional trade networks under Chinese influence, and the expansion of alternative economic arrangements like BRICS suggest a world adapting to diminished American leadership.

The financial implications are profound and far-reaching. Capital markets are already reconfiguring as investors hedge against American economic instability and diminishment. The $3 trillion in U.S. market capitalization lost since January reflects not just near-term uncertainty but a structural repricing of American economic prospects. The regionalization of trade is creating new economic corridors that bypass American markets entirely, shifting capital flows and investment patterns toward emerging centers of economic gravity. Bond markets in particular are signaling that the era of the U.S. dollar's uncontested reserve status may be waning as alternatives gain credibility.

The economic consequences for American households and businesses could be severe. Beyond the immediate recession threat lies a more profound challenge: adapting to a world where America's economic leverage has diminished. Rising borrowing costs, persistent inflation, reduced global market access and increased geopolitical instability threaten to create a prolonged period of economic stagnation unless policymakers (and voters) acknowledge these structural shifts. The great divergence is not merely a geopolitical phenomenon—it represents a fundamental realignment of the global economic order that will reshape financial markets, trade relationships, and economic opportunity for decades to come. America's economic future depends on whether it can adapt to this new reality or continues to accelerate its own marginalization through policy choices that hasten, rather than halt, this historic global divergence.