Testing Resilience: America's Economic Self-Sabotage

A barrage of aggressive policies - from trade wars to mass deportation plans - risks transforming an economic cooldown into an unnecessary crisis of America's own making.

As if navigating an economic slowdown were not difficult enough, America seems determined to make it harder. The economy's natural deceleration—GDP growth easing to 2.3% in the fourth quarter of 2024 from 3.1% in the third—has been complicated by a series of policy own goals. Donald Trump's aggressive protectionist agenda, crowned by an obsession to impose tariffs on its closest allies and commercial partners, threatens to turn what might have been a controlled slowdown into something more troubling.

A Triple Threat to Stability

Three self-imposed challenges threaten to accelerate this slowdown. First, America's protectionist turn risks triggering a global economic recession. Beyond the immediate effects of the tariffs—the Peterson Institute projects U.S. inflation could rise half a percentage point in 2025, while Goldman Sachs warns of a 1-2% hit to S&P 500 earnings for every five-point tariff increase—the structural damage could be profound. Global supply chains, carefully constructed over decades, face disruption just as they had recovered from pandemic shocks. A stronger dollar threatens to make U.S. exports increasingly uncompetitive. Meanwhile, China's swift retaliation with 10-15% tariffs on American energy exports suggests a spiral of reciprocal barriers that could choke global trade flows and weaken demand worldwide—precisely when the global economy can least afford it.

A related concern is the market's dangerous concentration in AI-driven tech stocks amid broader stock overvaluations. The S&P 500 trades at 22 times earnings, well above its historical average of 16, while the "Magnificent Seven" tech companies command even steeper multiples on aggressive AI growth projections. Last week's DeepSeek shock—which erased nearly $1 trillion in market value after the startup demonstrated AI capabilities rivaling those of major tech companies at a fraction of the cost—shows how fragile these valuations are. This concentrated exposure creates systemic risk: any disappointment in AI adoption rates, profitability, or competitive position could trigger a broader market correction, particularly as stagnant or rising rates could make these growth stocks' future earnings less valuable. With retail investors pouring money into already expensive shares, the market appears dangerously positioned for a correction. Beijing's targeted response to U.S. trade policy—restricting critical mineral exports and launching antitrust investigations—adds geopolitical risk to this already precarious tech concentration.

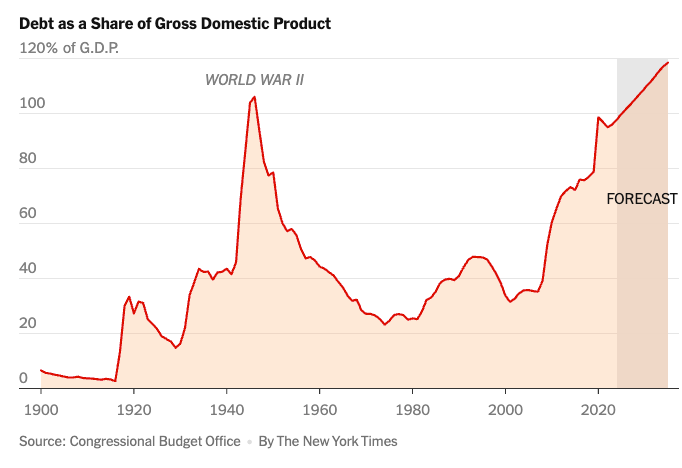

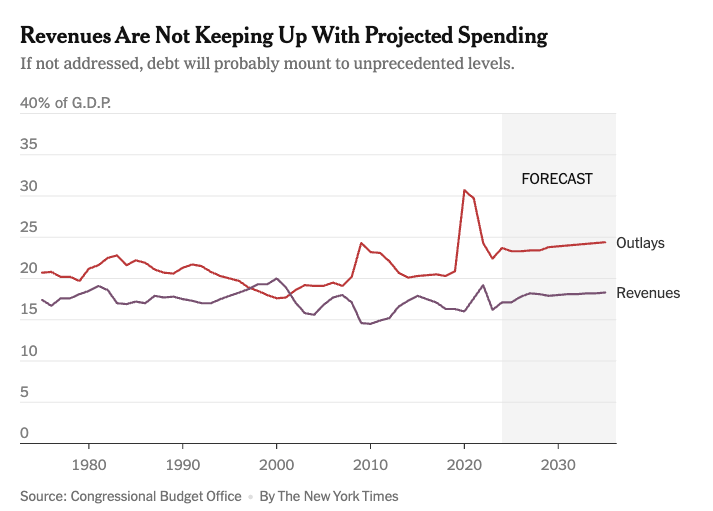

Second, fiscal and monetary pressures are building at precisely the wrong moment. The national debt has grown dramatically over the past 25 years - it's now three times larger compared to the economy than it was before. This growing debt creates a problem: the government needs to borrow even more money by selling Treasury bonds. But this comes at exactly the wrong time, since high interest rates make borrowing much more expensive. According to JP Morgan, these debt pressures are likely just the beginning, with a major funding shortfall expected by 2026. More supply in the bond market tends to push prices lower, since increased debt issuance requires more buyers to absorb the new supply, leading to higher yields.

Meanwhile, the Federal Reserve is dealing with its own separate challenge: a difficult choice between fighting inflation caused by tariffs by raising interest rates (should the economy overheat), or supporting economic growth by lowering them, as demanded by President Trump. For now, the Federal Reserve has chosen to follow a “wait and see” approach.

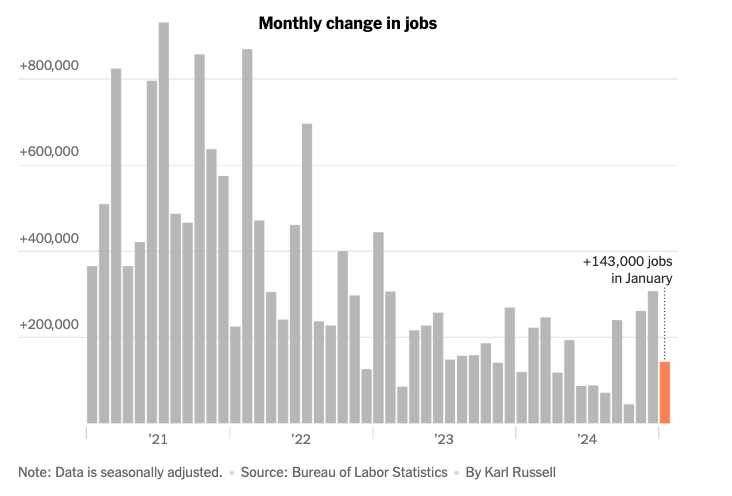

Third, the "mass deportation" policy enforced by the Trump administration threatens labor market stability in a complex way. Recent economic data already shows signs of labor market strain: while unemployment edged down to 4%, January's job creation of 143,000 fell well short of the expected 169,000, and prime-age male labor participation has declined from July's peak of 89.9% to 89.4%. Should Trump's deportation initiatives reach their promised scale and net immigration turn negative, economists project a concerning scenario: a shrinking workforce that could drive wages higher without corresponding gains in productivity. This combination would be particularly damaging - bringing slower economic growth alongside higher wages, a classic recipe for stagflation.

Markets Struggle to Price Policy Risk

This policy uncertainty has created a striking divide in market sentiment between institutional and retail investors. On one side, institutional investors have grown notably cautious - the VIX "fear gauge" stands at 15.45, and CNN's Fear & Greed Index has dropped to 42, firmly in "fear" territory. Yet on the other side, retail enthusiasm remains remarkably strong, with investors pouring $12 billion into equities last week alone. This retail investment is highly concentrated, with 70% flowing to just the "Magnificent Seven" tech stocks. However, this concentration looks increasingly risky as China responds to American protectionism with targeted countermeasures against these very companies - from antitrust investigations into Google to restrictions on critical mineral exports.

Signs of Underlying Strength

America's economic resilience remains striking across multiple sectors. The healthcare sector continues to innovate brilliantly, as shown by Eli Lilly's weight-loss drug Zepbound, which generated $1.91 billion in revenue last quarter - a tenfold increase that drove the company's shares up 3.3%. Consumer spending demonstrates similar strength, though with a shift from ultra-luxury to affordable luxury: Ralph Lauren and Tapestry (owner of Coach and Kate Spade) surged 9.7% and 12% respectively to all-time highs. Even the bond market shows remarkable stability amid high market volatility, with 10-year Treasury yields staying within a narrow 4.5-4.8%, with average daily moves near zero as fluctuations largely cancel each other out. The MOVE Index, a widely followed gauge of bond market volatility, has declined 8.4% in 2025 and recently hit a five-week low, trading below 90.

This resilience stands in sharp contrast to weakness elsewhere. European markets hemorrhaged $75.9 billion from equity funds in 2024 while American markets attracted $417.6 billion—a vote of confidence in America's fundamental strength that makes the pivot toward protectionism all the more puzzling. The European Central Bank's recent rate cut to 2.75% partly reflects concern about trade uncertainty, while even the Bank of Japan's first rate hike in 17 years underscores the peculiarity of America choosing this moment to rock the global economic boat.

Flight to Safety

Faced with mounting policy uncertainty, investors are increasingly turning to traditional safe harbors. Gold has been a primary beneficiary, reaching fresh all-time highs driven by multiple factors: safe-haven demand, central bank buying, and economic uncertainty. UBS has raised its 12-month gold price forecast to $3,000 per ounce, citing tariff jitters and global financial instability. Central banks' gold-buying streak has now stretched to 15 consecutive years with no signs of slowing, reflecting a strategic shift toward hard assets. This institutional demand is matched by retail interest, with physical gold demand surging in New York markets.

The flight to safety extends beyond precious metals. Silver has gained 0.8% to $32.392 per troy ounce, up 12% year to date. Fixed-income markets are also benefiting, with the 10-year Treasury yield falling to 4.542% amid increased demand. Bond funds have attracted inflows for five consecutive weeks, pulling in $9.22 billion just last week, while money market funds have seen even larger inflows of $39.61 billion.

The Paradox of Self-Sabotage

The irony is that America's economy demonstrates remarkable underlying strength even as it navigates a natural slowdown. Rather than test this resilience with protectionism and confrontation, the Trump administration could focus on structural reforms that would reinforce it. Comprehensive tax reform could improve competitiveness without resorting to tariffs. Regulatory optimization could reduce business costs while preserving essential safeguards. Most urgently, addressing the looming debt crisis through fiscal reform would create space for private sector growth, reduce government debt servicing costs and appease bond vigilantes. Perhaps most importantly, rather than disrupting global trade, the Trump administration could focus on building resilient global supply chains that protect American interests while acknowledging geopolitical realities. These measures would better serve an economy that, despite its challenges, remains fundamentally sound. The path to sustained prosperity lies not in economic nationalism but in strengthening America's structural advantages. This includes its allies and closest economic partners.